Annual filings for LLP (Limited Liability Partnership): Low COST, Certified Process

✅ Trusted by 10,000+ businesses

✅ Fast and Reliable Service

✅ Dedicated Account Manager

₹7,999

Fast and Affordable Annual Compliance for LLP Companies

Ensuring Annual filings for LLP is crucial for maintaining legal compliance, financial transparency, and operational efficiency. This comprehensive guide will walk you through the various aspects of Annual filings for LLP, the benefits, mandatory compliance requirements, and how MyCAfiling offers cost-effective and efficient services for your LLP’s compliance needs.

Annual filings for LLP in India

Annual filings for LLP (Limited Liability Partnerships) in India must adhere to specific compliance requirements as outlined by the Ministry of Corporate Affairs (MCA). These requirements ensure that LLPs operate within the legal framework, maintain transparency, and uphold good governance standards.

Key Components of Annual filings for LLP:

- Annual Return Filing (Form 11): Submission of the annual return to the Registrar of Companies (RoC) within 60 days of the end of the financial year.

- Statement of Accounts and Solvency (Form 8): Filing of financial statements and solvency declaration within 30 days from the end of six months of the financial year.

- Income Tax Return Filing: Annual filing of income tax returns by the due date specified under the Income Tax Act.

- Other Event-Based Compliance: Filing necessary forms and documents for any changes in LLP structure, partners, or registered office.

What are LLP (Second Amendment) Rules, 2022?

The LLP (Second Amendment) Rules, 2022, introduced by the Ministry of Corporate Affairs, aim to streamline compliance procedures and provide ease of doing business for LLPs in India. These amendments include:

- Changes in the Definition of Small LLPs: The threshold for a small LLP has been revised, making it easier for smaller entities to comply with regulations.

- Introduction of New Forms: Simplified and revised forms for ease of filing and compliance.

- Changes in Penalty Provisions: Revised penalties for non-compliance, with a focus on ensuring adherence to regulatory requirements without imposing undue burdens on LLPs.

Benefits of Annual filings for LLP in India

Adhering to Annual filings for LLP offers several advantages:

- Legal Protection: Ensures the LLP operates within the legal framework, minimizing the risk of legal penalties or disputes.

- Enhanced Credibility: Demonstrates transparency and good governance, which can enhance the LLP’s reputation among investors, clients, and partners.

- Financial Stability: Regular compliance helps in accurate financial reporting and management, which is crucial for business planning and funding.

- Avoid Penalties: Helps in avoiding fines and penalties associated with non-compliance.

- Investor Confidence: Builds trust with investors and stakeholders, making it easier to attract investment and business opportunities.

All Mandatory Annual filings for LLP in India

Annual Return Filing (Form 11)

Every LLP must file an annual return with the RoC within 60 days from the end of the financial year. This form provides details about the partners, their contributions, and changes, if any, in the LLP.

Statement of Accounts and Solvency (Form 8)

LLPs are required to file their financial statements and a declaration of solvency within 30 days from the end of six months of the financial year. This includes the balance sheet, profit & loss account, and a statement of solvency.

Income Tax Return Filing

LLPs must file their income tax returns annually by the due date specified under the Income Tax Act. The due date varies depending on whether the LLP is subject to a tax audit.

Other Compliance Requirements

- Designated Partner KYC: Every designated partner must file their KYC details annually.

- Maintenance of Statutory Registers: LLPs must maintain statutory registers, including those of partners and their contributions.

- Conducting Annual Meetings: While not mandatory, LLPS should conduct annual meetings to discuss financial statements and compliance matters.

What are the Consequences of Non-Compliance for LLPs?

Non-compliance with the annual filing requirements can lead to severe consequences, including:

- Financial Penalties: LLPs may face hefty fines for failing to meet compliance deadlines.

- Legal Action: Continued non-compliance can result in legal action against the LLP and its designated partners.

- Dissolution of LLP: Persistent non-compliance may lead to the dissolution of the LLP by the RoC.

- Loss of Credibility: Non-compliance can damage the LLP’s reputation, making it difficult to attract investors and clients.

Why MyCAfiling?

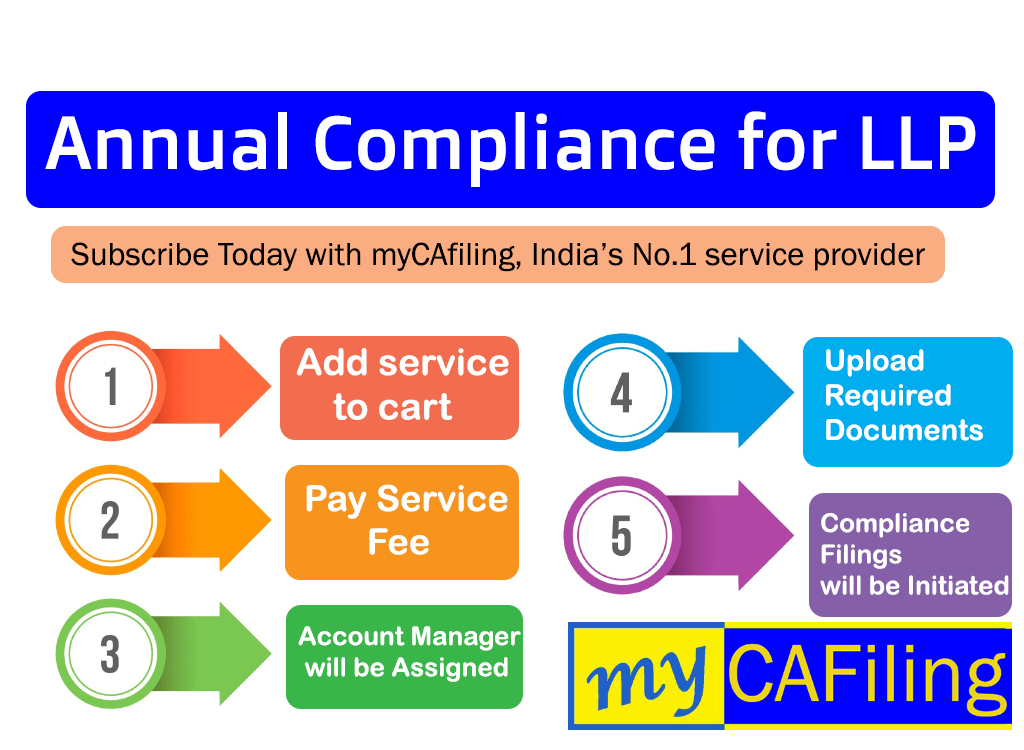

MyCAfiling offers a comprehensive solution for Annual filings for LLP at a low cost. Here’s why choosing MyCAfiling is beneficial:

- Expert Assistance: Professional guidance to ensure all compliance requirements are met efficiently and accurately.

- Affordable Services: Cost-effective solutions for annual compliance, making it accessible for businesses of all sizes.

- Streamlined Process: A user-friendly platform that simplifies the compliance process, saving you time and effort.

- Timely Filings: Ensures that all filings and submissions are made on time to avoid penalties and legal issues.

- Comprehensive Support: Assistance with not only annual compliance but also with other legal and regulatory requirements.

15 FAQs About Annual Filings for LLP

- What are annual filings for LLP?

Annual filings for LLP refer to the mandatory compliance requirements that an LLP must fulfill every year, including filing annual returns, financial statements, and income tax returns. - Why is Annual filings for LLP important?

It ensures legal adherence, avoids penalties, enhances credibility, and maintains financial stability. - What is the deadline for filing Form 11?

Form 11 must be filed within 60 days from the end of the financial year. - What is the significance of Form 8?

Form 8 includes the LLP’s financial statements and a declaration of solvency, which must be filed within 30 days from the end of six months of the financial year. - When is the income tax return due for LLPs?

The due date varies depending on whether the LLP is subject to a tax audit. Generally, it is July 31st for non-audited LLPs and September 30th for audited LLPs. - What happens if an LLP fails to file annual returns?

Non-compliance can result in financial penalties, legal action, and even dissolution of the LLP. - How can MyCAfiling assist with LLP compliance?

MyCAfiling provides expert guidance, affordable services, and a streamlined process to ensure all compliance requirements are met efficiently and accurately. - Are there any penalties for late filing of Form 8?

Yes, late filing of Form 8 can attract penalties as specified by the MCA. - What are the LLP (Second Amendment) Rules, 2022?

These rules aim to streamline compliance procedures and provide ease of doing business for LLPs in India. - What are the benefits of LLP compliance?

Benefits include legal protection, enhanced credibility, financial stability, avoidance of penalties, and increased investor confidence. - Is it mandatory for LLPs to conduct annual meetings?

While not mandatory, LLPS should conduct annual meetings to discuss financial statements and compliance matters. - What are statutory registers?

Statutory registers are official records that an LLP must maintain, including registers of partners and their contributions. - Can non-compliance lead to the dissolution of an LLP?

Yes, persistent non-compliance may lead to the dissolution of the LLP by the RoC. - What is the role of a designated partner in LLP compliance?

Designated partners are responsible for ensuring the LLP meets its compliance requirements, including filing annual returns and financial statements. - How does MyCAfiling ensure timely compliance?

MyCAfiling uses a user-friendly platform to manage and track compliance deadlines effectively, ensuring all filings and submissions are made on time.

Conclusion

Ensuring Annual filings for LLP is critical for maintaining legal compliance, financial transparency, and operational efficiency. By understanding the various compliance requirements and leveraging services from MyCAfiling, you can efficiently manage your LLP’s compliance needs at a low cost. Register with MyCAfiling today and take advantage of their comprehensive and cost-effective compliance solutions.

| View All Services |

| MCA website |

Based on 285 reviews

|

|

|

53.68% |

|

|

|

46.32% |

|

|

|

0% |

|

|

|

0% |

|

|

|

0% |

You must be logged in to post a review.

285 reviews for Annual filings for LLP (Limited Liability Partnership): Low COST, Certified Process

- 12a 80g Registration

- 12a Registration For Section 8 Company

- 80g Registration For Section 8 Company

- Annual Compliance Of LLP

- Annual Filing Forms For LLP

- Annual Filing LLP

- Annual Filing Of LLP After Incorporation

- Annual Filing Of LLP With ROC

- Annual Filings For LLP

- Charity Trust Registration

- Company Liquidation

- Mandir Trust Registration

- Ngo Procedure For Registration

- Ngo Registration

- Ngo Registration Online

- Ngo Registration Process

- Private Trust Registration

- Procedure To Register Ngo

- Procedure To Start An Ngo

- Process To Register Ngo

- Public Trust Register

- Register A Trust

- Register Ngo Online

- Register Of Trust Deeds

- Register Section 8 Company

- Register Trust Online

- Registration Of Non Governmental Organization

- Registration Of Startup In India

- Sec 8 Companies Act

- Sec 8 Company

- Section 8 Company Registration

- Section 8 Company Registration Fees

- Section 8 Company Registration Online

- Section 8 In Companies Act 2013

- Section 8 Microfinance Company Registration

- Section 8 Microfinance Company Registration Fees

- Section 8 Ngo Registration

- Startup India Registration Eligibility

- Startup India Registration Online

- Startup India Registration Process

- Trust Deed Registration

- Trust Registration

- Trust Registration Online

- Voluntary Liquidation

- Winding Up Of A Company

Sandeep Raj (verified owner) –

MyCAfiling offers annual filings for LLP with low COST and a fast process. Register with MyCAfiling for the best rates!

Sumit (verified owner) –

MyCAfiling made annual filings for LLP easy and affordable. Register with MyCAfiling for the lowest cost!

Neeraj Chopra (verified owner) –

MyCAfiling offers the lowest cost for annual filings for LLP. Fast Process. Register with MyCAfiling!

Kavita (verified owner) –

MyCAfiling offers the best rates for annual filings for LLP. Low COST, Fast Process. Register with MyCAfiling!

Mohan (verified owner) –

Annual filings for LLP with MyCAfiling are budget-friendly and quick. Low COST, Fast Process. Register with MyCAfiling!

Rohit (verified owner) –

MyCAfiling made annual filings for LLP hassle-free. Low COST, Fast Process. Register with MyCAfiling for the lowest cost!

Rajat Mathur (verified owner) –

Affordable and fast annual filings for LLP with MyCAfiling. Register with MyCAfiling for the best value!

Amit Menon (verified owner) –

MyCAfiling offers efficient and low-cost annual filings for LLP. Register with MyCAfiling for the lowest cost!

Kavita Patel (verified owner) –

Affordable and fast annual filings for LLP with MyCAfiling. Register with MyCAfiling for the lowest cost!

Rhea (verified owner) –

Annual filings for LLP with MyCAfiling are quick and budget-friendly. Low COST, Fast Process. Register with MyCAfiling!

Vandana (verified owner) –

MyCAfiling offers the lowest cost for annual filings for LLP. Fast Process. Register with MyCAfiling!

Meena (verified owner) –

Affordable annual filings for LLP at MyCAfiling. Low COST, Fast Process. Register with MyCAfiling!

Kunal Tyagi (verified owner) –

MyCAfiling provides budget-friendly and quick annual filings for LLP. Register with MyCAfiling for the lowest cost!

Arun Bansal (verified owner) –

Efficient and affordable annual filings for LLP with MyCAfiling. Register with MyCAfiling for the lowest cost!

Rhea Gupta (verified owner) –

MyCAfiling provides the lowest cost for annual filings for LLP. Fast Process. Register with MyCAfiling!